The day is here, does Trump dump?

Getting my meager financial geek on. I have laid in Costco quantities of popcorn.

The backdrop

When TMTG went public earlier this year, it “popped” to near $80 (ok, $79.38), as Trump’s fanbase piled in to get it to that level. But it was clear from the start that DJT1 was a meme stock, that it really wasn’t a healthy business, but instead it was a vanity project that is like almost everything that Trump has associated himself with.

It typically is a low volume trading equity, that means that small volumes drive pretty wide swings in its market price, couple that with the - shall we say unsophisticated Trump supporters who dominate the retail investors of this security, it is not a very stable stock. Looking at the chart from its IPO to today, it looks somewhat like this:

I am not a financial advisor, but this is not really a good trend-line.

Stocks usually track a company’s performance. Blow out analyst forecasts at earnings time? It goes up. Report a lawsuit for patent infringement? It falls like a stone.

But the truth is that Truth Social, the only “product” offered by DJT is a dog2.

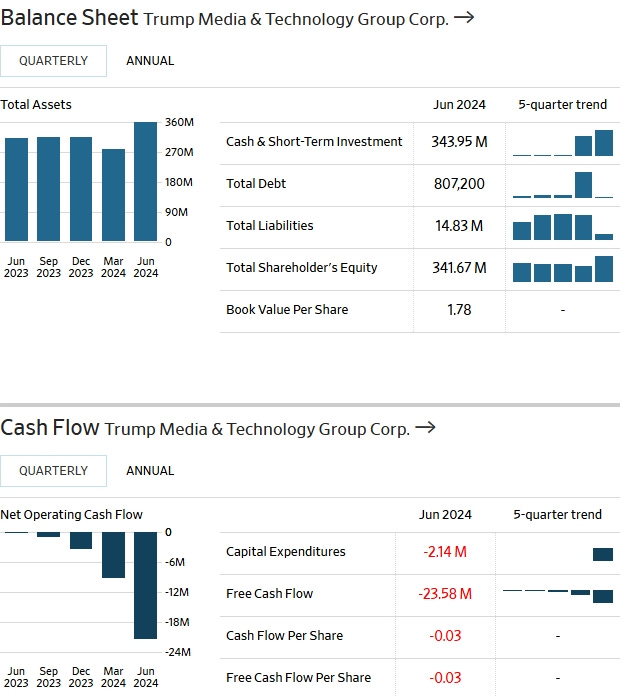

From the WSJ’s page on it (link), we see that this is not a good business. One of the things that jumps out at me is the balance sheet and cash flow. Check this out:

Note that the “book value” is $1.78 per share. That is what it is worth, not looking at future earnings. That is what a fair market value is for that share. Currently trading at $14.70, you can clearly see that it is way over valued.

You might ask “but Sweaty, it must be worth nearly $15 a share, because markets are rational…” to which I just …

No, the market is not rational.

So, it is a terrible investment, and if you have your retirement accounts heavy in it, well, bless your heart.

Why today is important

Prior to going public, a corporation has shares. They are just privately held. When a person - called a “Founder” starts a business with their own capital (aka money), they own 100% of the newly created company. Often they need to hire people to help them create whatever good or service they are selling (or trying to sell). Usually, they do not want to pay them handsomely, so instead they pay them some cash, but they often take their pocketknife to the 100% block of “equity” and carve off a share to give to the employee. This is wise, as it will incentivize them to work their ass off, because if the company hits it big, they own a piece of it.

Startups are often driven this way.

Also, the founder’s bank account may become strapped, so they need more money. They will then don their best Jos. A. Banks suit and power tie, build a compelling pitch deck, and go try to get funding from VCs or angel investors. Again, they carve off part of their holdings, to get access to the lubricating cash.

The VC’s make bets like this in the hope that it is huge (like Facebook) and theyu get even more money.

But before the company goes public, there is nowhere for these equity holders to turn their “share” of the company into cold hard cash.

The IPO or Initial Public Offer is the day that the company gets listed on an exchange (usually the NYSE, or NASDAQ) and then us grubby outsiders get a chance to buy these shares.

I bet you’re wondering why the long rambling path to get here. Glad you asked!

As you might imagine, a successful company that gets listed on an exchange, all these early employees, and outside funders might want to cash out.

And all of them selling at once on the day it gets listed would drive the value of the stock to about $0. Generally, that is a Bad Thing (tm). To prevent that, the paperwork to go public often has terms of “lock up” for certain early investors (VCs) and employees. Commonly, this term is 6 months3. Thus, the insiders have a vested interest in the long-term viability of the company.

Back to DJT. Today is the first day that the majority stockholder can sell their stock. It will not surprise you that the majority shareholder is the man whose initials are the stock ticker symbol, Donald John Trump.

Trump hold 57% of the outstanding stock. At close yesterday, the book value of DJT was $2.925B dollars. That means, on paper, Trump is sitting on $1.67B worth of this paper.

If Trump were confident in the success of Truth Social, he would sit on that stock and let it appreciate and incentivize the stellar management team to continue their outstanding stewardship.

But if there is one thing we know about Trump it is that he wants his binky now, and since he has about a half billion in outstanding civil judgements against him, he needs cash.

And his one way to get cash is to unload DJT at the open.

What happens if Trump liquidates?

Well, that $14.70 price will drop like a stone. If 57% of the total shares hit the market as a sell order, there needs to be buyers, and the daily average volume of shares traded is about 2.9M. My calculations are that trump has about 113.4 million shares. There is no way he can sell that much today, as there aren’t enough Trump voters with cash to buy a piece of DJT.

The largest day of trading I have seen4 was about 9M shares. If that price holds, and there are enough suckers to spend $14.70 a share, Trump will net $117.6M.

But no way that happens. The price will plummet. How far? $10? $5?

That is what I am looking for.

I will be a monkey’s uncle if Trump actually is disciplined and holds. No, the smart money is to bet against this turd. I am too lazy to look up the short positions on this, but I bet a lot of the smart money on the street is shorting the fuck outta this.

The market opens at 6:30 (I’m on the west coast) so, whilst I am walking my dog, I will open my stock app on my phone and see if my surmise is correct.

I hope none of my readers is holding any of this shitty stock.

DJT is the stock ticker, but it is also an acronym that is defined in the Urban Dictionary. You can look it up here - but I warn you that it may be an icky definition.

I hate this term of art, being a dog dad, but it is the term.

I am overly simplifying here, don’t @ me.

It has been my kink to watch this every day, don’t judge me…

When Trump sells he’ll frame it as act of selfless altruism, allowing his loyal supporters to share in this amazing, once in a lifetime opportunity. He could keep this beautiful wealth to himself but, no, that’s not his style. So come on suckers, uh, I mean patriots! Take your first step toward financial independence while sticking it to the naysayers of the fake news, radical left, fascist communists financial reporters and analysts. MAGA!

I wonder if Trump has a buyer all picked out ahead of time. We should know soon.

Thanks for this great description of the waiting period. It's very helpful.